2025-11-07

The Levelized Cost of Storage, or LCOS, is the main metric that indicates the economic performance of Battery Energy Storage Systems.

It represents how much it would cost to deliver one MWh of stored electricity through the system over its lifetime, including investment costs, operation costs, and maintenance costs.

Throughout this article, all cost figures are in $/MWh and represent system-level economic performance.

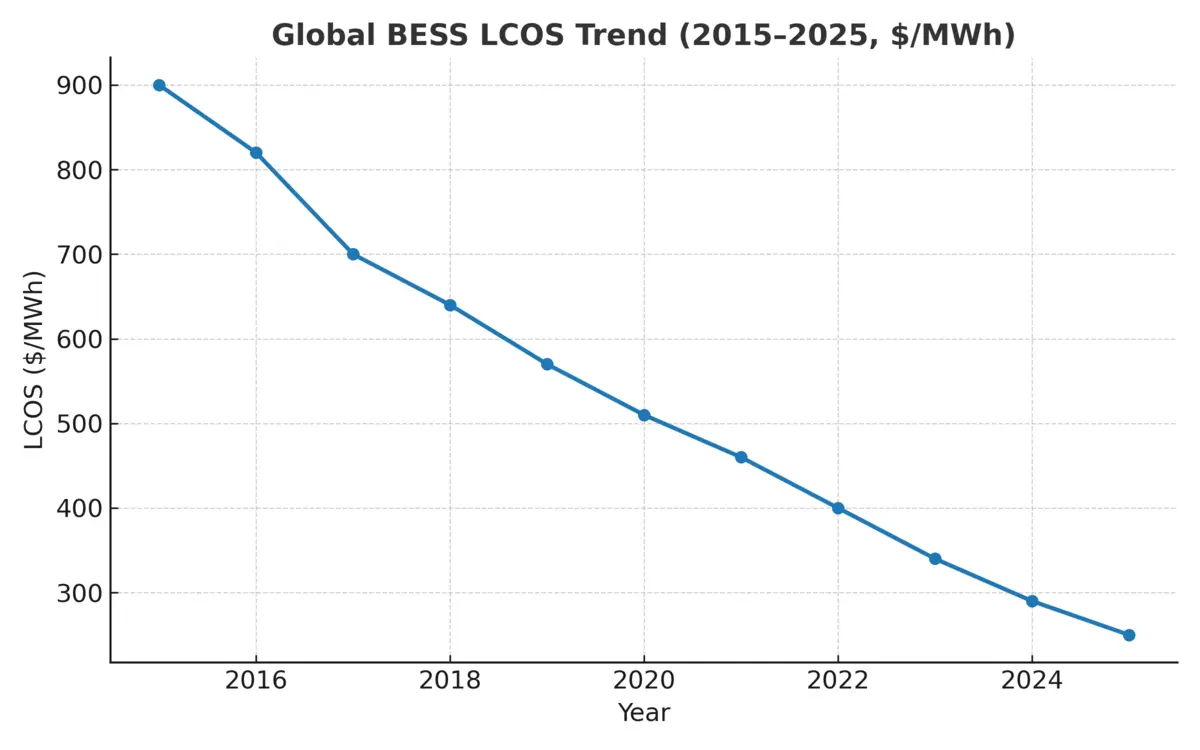

From 2015 to 2025, LCOS for lithium-based BESS decreased by about 60% due to declining battery cell prices, improved energy density, and higher efficiency in power conversion systems.

| Year | Average LCOS ($/MWh) | Key Factors |

| 2015 | ~900 | High lithium costs, early-stage tech |

| 2018 | ~650 | Larger deployments reduce balance-of-system cost |

| 2020 | ~500 | Mass production in China, U.S. |

| 2023 | ~320 | Supply chain maturity, lower CAPEX |

| 2025 | ~250 | Energy density >250 Wh/kg, digital optimization |

The downward trend indicates how energy storage is rapidly approaching the economic parity point with traditional gas peaker plants. In many regions, especially the U.S. and China, storage is now cost-competitive for short-duration grid balancing.

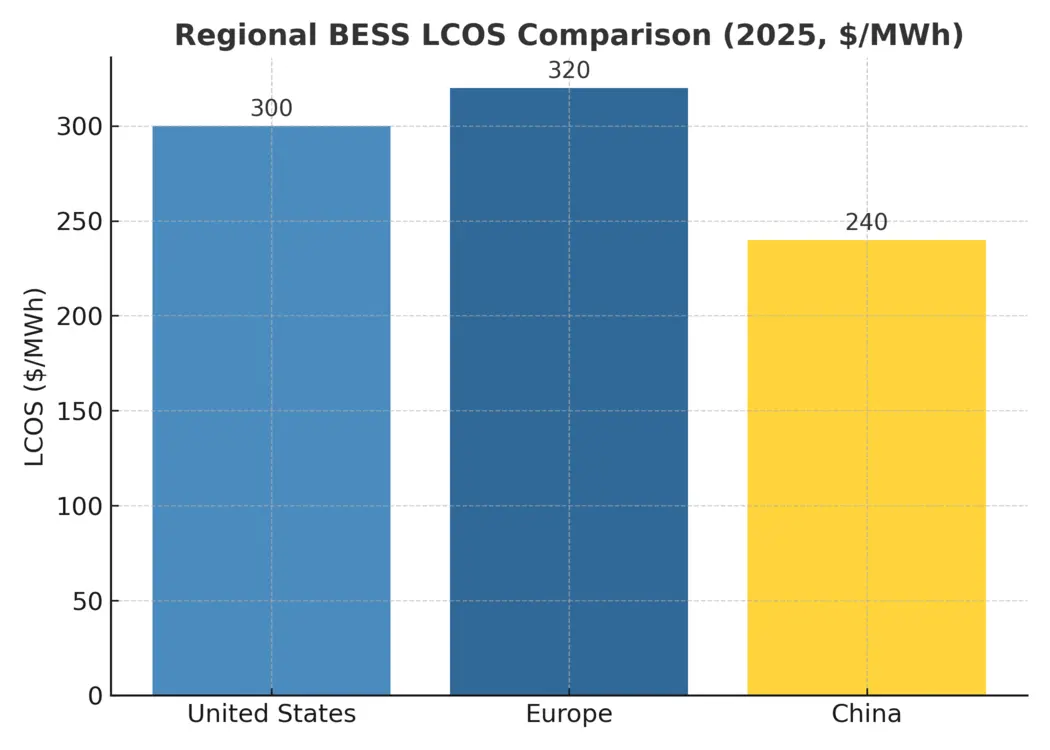

While global LCOS has converged, there are still regional differences caused by specific electricity markets, policy incentives, and supply chain maturity.

| Region | 2025 LCOS ($/MWh) | Characteristics |

| United States | 270–320 | High labor cost but strong incentives (IRA) |

| Europe | 280–340 | Renewable integration driving storage adoption |

| China | 200–260 | Local battery supply chain keeps costs lowest |

China currently leads in manufacturing scale and system integration efficiency, enabling lower LCOS compared to Western markets.

However, this disparity is expected to decrease by 2030 as Europe and the U.S. speed up their energy transition programs.

The three main factors shaping the LCOS curve are:

Looking ahead, analysts from BloombergNEF and Wood Mackenzie expect LCOS to fall below $150/MWh by 2030, especially as hybrid renewable-storage projects scale globally.

With commercially available solid-state and sodium-ion batteries, LCOS could reach near parity with conventional generation at around $100/MWh by 2035.

Key Future Trends:

In practical experience with energy projects, the turning point for LCOS isn't just battery chemistry - it's integration intelligence.

Smart controls, modular PCS, and scalable thermal management are redefining the cost curve at a much faster pace than could be achieved with just cell-level innovation.

For developers and investors, 2025–2030 will be the decade when LCOS will define competitiveness, not just technology.

European 4MWh Energy Storage Project

Shanghai Huijue Solar Carport Project

Small Commercial Energy Storage System Project for Singapore Manufacturing Companies

China Hunan Province Scenic Area Microgrid System Project

Northern Europe Commercial Center Outdoor Cabinet Industrial and Commercial Energy Storage System Project